A Biased View of Student Loan Borrowers Got the Debt, but Not the Degree

Elizabeth Warren's Student Debt Forgiveness Plan Popular With Voters

All About Let's forgive student debt, but only for the hardest-luck borrowers

it could be rather complex logistically. For circumstances, the administration is imposing an earnings cap on who certifies to guarantee that high earners do not receive federal government help they do not require. But there are hurdles to utilizing income to target debt relief. The Education and Treasury departments can not easily share debtors' tax info, and legislation alleviating the constraint will not work for two years.

A self-attestation procedure, where individuals would license that their earnings qualifies, might present obstacles for the government to confirm the information. Even asking borrowers to obtain forgiveness could limit the reach of the policy. And because Check Here For More will take months for the Education Department to implement any program, the political advantages might be limited.

Can We Design Student Loan Forgiveness to Target Low-Income Families? - Urban Institute

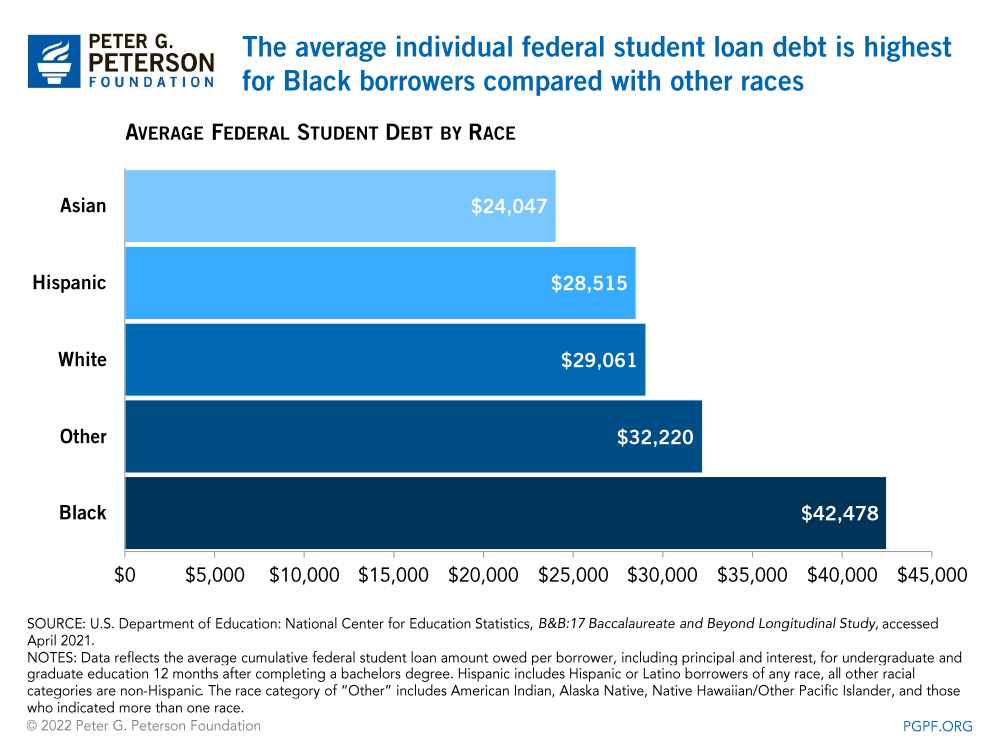

Schumer (D-N.Y.), have actually prompted the administration to go much more and cancel at least $50,000 per customer, if not all outstanding federal education loans. They state decreasing the burden of student loans would assist promote the economy and close the racial wealth gap, as Black debtors take on a disproportionate amount of financial obligation.

Biden Searches for Political Sweet Spot on Student Debt for Beginners

The Committee for an Accountable Federal Budget estimated that roughly 70 percent of the benefit will go to those in the leading half of the income spectrum. Critics of financial obligation forgiveness likewise state it does nothing to address college costs or the troubled lending system. It's not clear whether individuals who need to borrow to start college this fall, for example, would be eligible to have actually new loans forgiven.

Defaults and delinquencies on trainee loans were focused among debtors with less than $10,000 in financial obligation prior to the pause of federal student loan payments, according to the Federal Reserve. Economic experts at the Fed say borrowers with the least amount of debt frequently have problem repaying their loans, in part due to the fact that they did not complete a degree needed to enhance their revenues.

The administration has actually already erased $18. 5 billion in loans for more than 750,000 individuals by briefly expanding or simplifying existing forgiveness programs, including those designed to assist public servants and borrowers defrauded by their colleges.